Worldwide tablet shipments slowed during the second quarter, possibly because consumers are awaiting a next-generation iPad, according to a report from IDC.

Vendors shipped 45.1 million devices in the second quarter of 2013, the firm reported — a 9.7 percent dip from the first three months of the year. However, worldwide shipments were up more than 59 percent from the same period a year ago.

The decline between quarters could be explained by consumers holding off on purchases until Apple launches the next iPad model, IDC suggested.

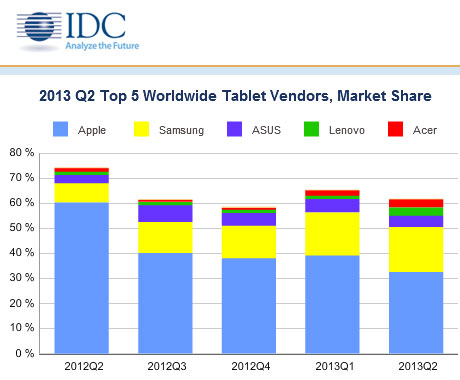

Apple remains the top tablet vendor, but it shipped a lower-than-expected 14.6 million units for the quarter, down from the 19.5 million it shipped in the three preceding months.

Samsung shipments also declined in the second quarter, down to 8.1 million tablets from the 8.6 million shipped in the first quarter. Samsung came in comfortably ahead of third-place Asus, which shipped 2 million tablets.

In fourth place was Lenovo, with 1.5 million tablets shipped, an increase of more than 300 percent from the same period a year ago and the first time the company shipped more than 1 million tablets in a quarter. Acer rounded out the top five with 1.4 million shipped.

Android and iOS are by far the leading software platforms for consumer tablets, with the operating systems running on 42.8 million of the units shipped in the quarter.

Microsoft’s Windows 8 and Windows RT platforms continue to struggle in the mobile space, accounting for 2 million of the tablets shipped in the quarter.

BlackBerry’s software powered just 100,000 of the tablets shipped.

Better Luck Next Time

The slowdown in the second quarter can be blamed mostly on consumer buying habits. Without any groundbreaking new tablets hitting the market, customers have no immediate incentive to buy, said Ben Bajarin, director and founder of Creative Strategies.

“The biggest thing to understand with tablets is that they are shifting to seasonal purchases,” he told the E-Commerce Times. “This explains why the mid part of the year is likely going to be slow for tablets. I think it’s safe to assume at a worldwide level that the holiday quarter will be quite large for tablets.”

With Apple’s launch of its latest iPad and the iPad mini last fall, it put itself on schedule to have stellar holiday seasons, said John Feland, CEO and founder of Argus Insights. Even if the numbers don’t show it in the second quarter, it is now in a better position to compete with the rest of the market.

“While it was good for Apple to get on a normal holiday schedule for iPad — realizing that they were losing marketshare to Android by not having something shiny and new for holidays — they took a hit in Q2 when you compare year over year,” he told the E-Commerce Times.

Looking Beyond the iPad

Apple’s next iPad will continue to drive tablet shipments throughout the market, said Bajarin, but the latest numbers from IDC show that the competition is intensifying. The company’s year-over-year growth dropped 14 percent, but the rest of the four vendors in the top spots all had year-over-year increases of more than 120 percent.

“I anticipate the Nexus 7 to do well overall, and we have yet to see what’s new from Amazon, but I anticipate any new Fires may do ok as well,” he added.

As the tablet market grows more crowded, Apple’s biggest challenge might be to outdo itself and launch a product that will excite consumers.

“Apple’s failure to surprise and delight users with recent launches puts increased pressure … on their fall line-up,” Bajarin observed. “Even if Apple is able to pull magic flying rabbits from their hat in the fall, it seems the tablet market has saturated to the point where they will be fighting for replacement rather than growth.”

Social Media

See all Social Media