In-home broadband has become “the fourth utility” in United States households, many of which have multiple connected devices and viewing screens. More than 85 percent of U.S. homes have broadband service, according to Parks Associates, 93 percent of those have DSL, fiber or cable high-speed, fixed-line Internet services.

The demand for high-speed fixed broadband is a key contributor to ongoing revenue and profitability for operators, particularly due to declines in pay-TV and landline voice subscribers.

The competitive market has changed vastly over the past two years, as have the services available. AT&T acquired DirecTV and launched an online pay-TV service (DirecTV Now) that it bundles with broadband, satellite TV and mobile.

Charter acquired TWC and Bright House to become Spectrum, which serves roughly 30 percent of the U.S. residential fixed broadband market — about 23 million consumers, similar to the size of Comcast’s customer base. Google halted expansion of its fiber service late last year after disrupting and accelerating broadband competition across the U.S. landscape.

Streaming Services

The way people use broadband also has changed. Over-the-top streaming services are a key part of home entertainment. Music streaming is seen as a source of new hope for the struggling music industry, and subscriptions to OTT video services have become the norm. Netflix, Amazon, Hulu and CBS All Access offer high-quality original content exclusively for distribution online through their services.

Operators and device makers have partnered with OTT video services, seeking to leverage their brands and popularity to drive uptake of higher broadband speeds and connected consumer electronics.

For example, Consolidated Communications recently announced a partnership to offer HBO Now along with its broadband services, providing an alternative to the traditional double-play bundle. These types of partnerships will become increasingly common as operators and OTT services both adapt to the new consumer entertainment marketplace.

Despite the demand for data, some fixed-line operators fear the possibility of consumers turning to their smartphones and cellular plans for home Internet connectivity. One-half of U.S. consumers with fixed home broadband also use their smartphones or tablets to connect to 3G or 4G at home, according to Parks Associates.

Fixed Advantages

However, fixed broadband has several key advantages over wireless data services that keep consumers from completely cutting the broadband cord:

- Cost — Compared to fixed home broadband’s average cost, mobile data is much more expensive on a price-per-bit basis. In fact, costs can be as much as 70 times more expensive, depending on the plans and monthly data allowances selected.

In some cases, fixed home broadband providers do not have a data limit, leading to fixed broadband’s “all-you-can-eat” pricing model that further increases the service’s effective usage value. Fixed home broadband also minimizes mobile data costs, providing consumers with low cost connectivity for in-home mobile traffic.

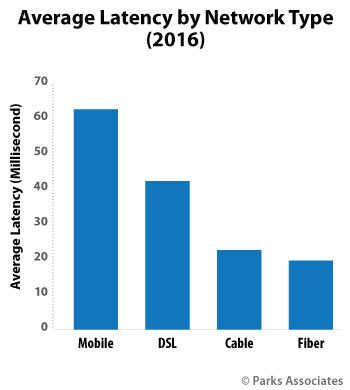

- Speed and latency — Mobile data services provide consumers with the convenience of having data on-the-go but often lack the high speeds and low latency available via fixed networks. Many consumers are aware of this gap, particularly in the use of applications that require high bandwidth or low latency, including file downloads (or uploads), online video games, and video streaming.

Mobile Internet network quality has improved, but mobile Internet averages latency that is 50 percent more laggy than DSL, the slowest fixed broadband connection technology. This performance difference often is the deciding factor in determining which data network, and devices, consumers opt to use.

Meanwhile, use cases for mobile often require lower levels of data network performance than use cases for devices that typically use a fixed broadband connection. For example, only 20 percent of broadband households stream TV and movie content on a smartphone from OTT services like Netflix or Hulu, according to Parks Associates consumer research, while 51 percent stream this long form content to their TVs and 38 percent stream to their PCs.

- Connected devices — Home broadband allows a large number of consumer entertainment devices to be connected to the Internet simultaneously, while performing high-bandwidth activities.

As of early 2017, U.S. broadband households owned an average of eight connected devices, including computing, entertainment and mobile devices. Penetration of computers among U.S. households stands at 87 percent, including both laptops and desktops, Parks Associates reported.

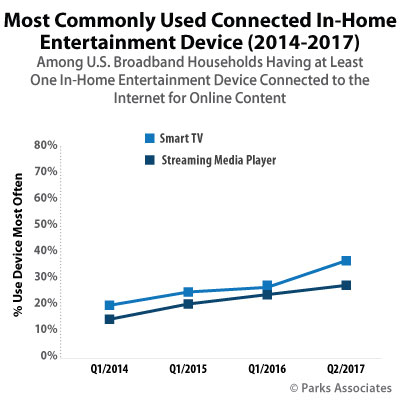

Beyond general data use (email and browsing), computers are a leading platform for video streaming and for downloading large files, two use cases that demand high-bandwidth connections. Adoption of other home entertainment devices, including smart TVs and streaming media players, has increased, and they have become the devices used most often for connected in-home entertainment.

Fixed home broadband is essential to smart home devices and the Internet of Things.

“You can’t have a smart home without seamless connectivity,” said Miles Kingston, general manager of the smart home group at Intel, during Connections 2017.

Most smart home devices are built to connect with smartphones and other devices. To fully integrate these devices, there is a requirement for a capable network that can connect multiple devices simultaneously. For this reason, broadband is the first functional foundation for connected home devices, due to its cost effectiveness and reliability.

- Data limits — More than half of mobile or wireless Internet traffic in 2016 came from video streaming (Ericsson Mobility Report June 2017), and consumers increasingly depend on fixed-line home broadband for this use case. High bandwidth use, particularly for 4K video via services like Netflix or Hulu, can burn through significant amounts of data quickly, which is a problem for services that impose relatively low data limits.

Though unlimited mobile data plans are becoming more common, many carriers implement mechanisms to throttle down throughput over a specified threshold of speed or data capacity.

While mobile data may not be an adequate substitute for all consumers, fixed broadband is not without its disadvantages. Cost is a leading reason for consumers to go without fixed broadband and rely exclusively on mobile data. As consumers start to look more deeply at their household expenses, cost considerations will go beyond subscription fees.

Fixed home broadband requires customer premises equipment, or CPE, for in-home access. Unlike a mobile device, which is multifunctional and owned by the consumer, most fixed-broadband CPE in the U.S. market is owned by the operator, rented to the user, and serves only one purpose, which would make it a prime target for households looking to cut expenses.

Parks Associates does not foresee consumers abandoning fixed broadband for mobile data services en masse, but in this environment of extreme competition, operators cannot afford to overlook these threats.

Working in Tandem

Mobile service providers will push their advantages, which includes a direct connection to consumers through their smartphones. Mobile services have begun positioning fifth-generation (“5G”) wireless technologies to compete against wireline technologies, which will give more options to consumers and put more pressure on fixed-broadband operators to innovate in order to retain their customers.

Fixed-line operators will protect their fixed-line revenues by increasing throughput, innovating in their CPE, reducing costs, and expanding coverage of their fiber deployments. There already is some evidence of this, with both fixed broadband providers and mobile data providers seeking new ways to add value to their services, such as free WiFi hotspots and zero-rating for online video streaming from associated OTT services.

They also will explore new areas, notably rural and underserved areas in the U.S. where fixed wireless technologies could be the best solutions for last-mile connectivity.

Though some substitution may occur, fixed-line and mobile data will continue to work in tandem to address consumers’ insatiable data needs. Fixed-line operators will benefit from wireless technologies in several ways over the next few years to drive improved satisfaction and greater revenues, further solidifying their position as valued providers of reliable data connections.

Great statistically analyzed article on broadband, and yes its true that most of the US citizens use and prefer broadband network. Thanks for writing on it