On June 10, Antenna Software completed the acquisition of Dexterra for an undisclosed amount, solidifying its position as a key player in the mobile middleware/platform space, with a sharpened focus on field force enablement. This market grab comes on the heels of Antenna’s acquisition of Vettro’s strategic assets in November 2008, a move that was made to increase market share in the IT service management and local transportation verticals.

The Dexterra purchase represents a major move by Antenna to grab share in a market seeing increasing demand for mobilized enterprise applications that are scalable, configurable and platform-agnostic; and that can mobilize a broad range of field force functions such as field service, sales, and customer support.

Expanding Its Market Reach

Aberdeen research continues to see increasing interest in and adoption of mobility across all organizations. In recent 2009 field service research, 83 percent of companies stated that fully connected mobility was either “extremely” or “very” important to financial and operational performance.

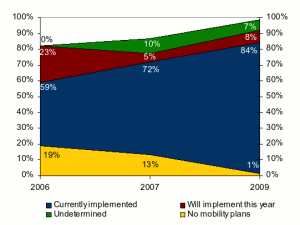

Aberdeen’s March 2009 benchmark, “More Mobility — Less Budget: Enterprise Strategies in the Current Economic Downturn,” found that enterprise mobility had “crossed the chasm” from a niche application to broad market acceptance. Figure 1 shows the growth of mobility initiatives among respondents from 2006 through 2009. During the period, the percentage of respondents who had a mobility initiative in place increased 42 percent, while the percentage of those who had no plans for mobility decreased by 93 percent.

Antenna’s core offering is the Antenna Mobility Platform (AMP), an extensible application platform upon which prefabricated applications such as AMP Service, AMP Sales and AMP Support are also built. Antenna continues to see increasing interest in flexible development platforms as opposed to specific point solutions, reflected in the acquisition of Dexterra and its Concert mobile development platform. The acquisition also gives Antenna access to Dexterra’s 100+ international customers, a majority of whom are in the field service space.

Expanding Its Capabilities

The acquisition also allows for expansion along the following lines:

- Functionality: The Mobile Command Center in Dexterra Concert offers robust workforce management capabilities, including an integrated scheduling engine that allows for dynamic workforce scheduling. Dynamic or real-time scheduling continues to be a differentiator for Best-in-Class companies. This is predicated on the ability to allow for the seamless integration of data between the mobile application and the enterprise scheduling application. The acquisition also allows Antenna to test the waters in the mobile asset management market, another one of Dexterra’s core strengths.

- Geography: While Antenna does support a number of global customers, more than 80 percent of its customer base is in North America. Dexterra does overlap with its presence in the North American market, and it has made progress in increasing market share in Europe, Middle East and Africa (EMEA), primarily through its channel relationship with Vodafone. Global markets present significant growth opportunities as reflected in Aberdeen’s January 2009 Insights on mobile field service in EMEA and APAC (Asia Pacific). EMEA respondents indicated that 49 percent of their mobile workers were equipped with mobile devices, up from 43 percent in 2007; while APAC respondents revealed rates of 55 percent and 40 percent for 2008 and 2007, respectively.

- Verticals: Prior to the acquisition, both organizations were competitors in the telecommunications and manufacturing verticals. While Antenna has also gained significant traction in healthcare and consumer packaged goods, the Dexterra purchase allows for expansion into the government and utilities verticals, representing approximately 20 percent of Dexterra’s customers.

- Device: Both platforms allow for use across multiple devices and operating systems. While a majority of Antenna’s customers leverage BlackBerry or Windows Mobile devices, Dexterra’s experience with Symbian devices increases the market reach of Antenna’s solution. Antenna’s recent focus on incorporating iPhone into the mix further expands their platform reach.

- Deployment Models: While at least 80 percent of Antenna’s customers are leveraging on-demand or hosted solutions, a majority of Dexterra’s customers leverage on-premise mobile solutions. With the acquisition, customers now have the option of selecting either deployment model as per their IT, security or business requirements.

- Partner Network: The acquisition also opens Antenna to Dexterra’s vast partner network for the development, sale and support of its platform. Dexterra has invested heavily in the development of this network over the last 12 to 24 months. While Antenna has a reseller agreement with AT&T, it can now tap into Dexterra’s relationships with carriers such as Vodafone and with systems integrators such as IBM and Accenture.

The Impact on Enterprise Mobility

Enterprise mobility long ago expanded beyond the initial productivity applications such as email, contacts and calendaring. In Aberdeen’s June report, “Mobile Device Management, Bringing Order to Enterprise Mobility Chaos,” 35 percent of respondents identified the need to securely mobilize enterprise applications as one of the top three pressures driving the need for mobile device management. Fifty-seven percent currently provide mobile access to in-house developed or customized applications.

We expect to see growing interest as mobile devices become more powerful and mobility itself becomes more entrenched in enterprise workflow and business culture. Antenna has chosen an opportune moment to grow by acquisition, and in the process has catapulted itself into the top tier of enterprise mobile application development platforms.

The Impact on Mobile Field Service

In Aberdeen’s “2009 Mobile Field Service AXIS,” Antenna Software outperformed a number of key mobile field service application providers to be proclaimed a “Contender” in the space. With the acquisition of Dexterra, the company is looking to take advantage of the significant interest in mobility in the field service space. Sixty-one percent of respondents to Aberdeen’s June 2009 survey indicate that they are currently leveraging some form of mobility (hardware, applications etc.) in their service operations when compared to 45 percent of respondents to a 2008 mobile field service research survey.

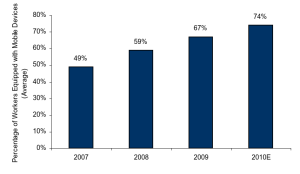

In terms of mobile device adoption, respondents reveal that 67 percent of their service workforces are currently equipped with work-specific mobile devices, up from 59 percent a year earlier. Estimates for 2010 indicate the need to raise this workforce adoption level to 74 percent. With access to a wider prospect base as highlighted above, the company should be able to advance its Market Awareness score in the 2010 Mobile Field Service AXIS.

The acquisition also helps further enhance Antenna’s strengths, which have always been the flexibility and configurability of its platform and solutions. In 2009, mobile field service research configurability was selected as a top selection criterion by 38 percent of respondents, with another 25 percent emphasizing the importance of scalability. Antenna’s prefabricated applications allow it to address the out-of-the box functionality requirement, while its extensible platform allows for the scalable deployment and improved integration with back-office systems.

Improved integration results, tied with the enhanced work order management and scheduling functionality added via the Dexterra Mobile Command Center, should also help Antenna’s customers drive better performance, thereby enabling the organization to add a couple of points to its Value Delivered score.

Concluding Thoughts

With financial markets depressed, company valuations undervalued, and mobility demand increasing, Antenna and its investors have chosen a key moment to make such a major acquisition. Given current conditions, the market is ripe for further consolidation in the near term, and Antenna has taken a significant step to grab market share. The synergies with Dexterra’s technology, customer base, and market presence are evident. There is overlap from a technology point of view, given that both were competing providers of mobile platforms, and it will be interesting to see how Dexterra’s technology will be utilized and supported in the Antenna road map.

On a cautionary note, Aberdeen’s 2009 mobile field service survey respondents indicate lukewarm reception to mobile development platforms for their field service offerings. Only 13 percent of all respondents indicate the use of such platforms, with another 7 percent showing buying interest in the next 12 months. Adoption rates for platforms are much lower when compared to those for homegrown applications (26 percent of respondents), mobile extensions to CRM or Service Management systems (23 percent of respondents), or for standalone point-mobile solutions (23 percent of respondents).

In addition to general inertia, these are the alternatives that the Antenna sales team is going to continue to have to duel with so as to generate the desired customer growth targeted with the Dexterra acquisition. While organizations looking for a broad mobility footprint are more likely to consider the platform approach, specific industry sectors such as field service (which constitutes a major growth target for Antenna) still indicate a preference for homegrown mobile applications, mobile extensions or point solutions.

To achieve its growth targets, Antenna should consider a stronger foray into the small and medium-sized business (SMB) marketplace. From all indications, the new Antenna will continue to focus on the enterprise market, a segment where mobile platform purchases and implementations are likely to require the replacement of an incumbent system.

In an economy where 48 percent of respondents are either delaying purchases or deployments of their mobile field service solutions, such an overhaul becomes even more challenging. However, in the SMB space there is the increased likelihood that the mobility experience is “net new.” A competitive price point may open up the option of entry into the mid-market, or at least the upper mid-market, where cost, flexibility and scalability are key selection criteria. With its expanded partner network enabled by Dexterra, Antenna will be well positioned to make headway in the SMB marketplace.

In addition, Antenna must remain flexible and respond strategically to the growing interest in the new “Web-scraping,” virtualized, and cloud-based mobile application models enabled by iPhone, Android, and webOS.

Andrew Borg is a senior research analyst for wireless and mobility at the Aberdeen Group. Sumair Dutta is a research analyst at Aberdeen.

Social Media

See all Social Media