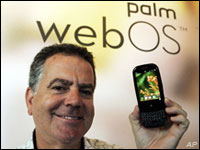

When Palm’s and Sprint Nextel’s latest bundle of smartphone joy, the Pre, arrives Saturday, it will be entering an increasingly crowded market backed by parents that have a lot riding on its success.

The Pre — which costs US$200 with a two-year service plan and rebate — might be most important to Sunnyvale, Calif.-based Palm, the very company that helped usher in the handheld computing era with the original Palm Pilot in 1996. These days Palm needs a resurgence in a market largely dominated by Apple’s iPhone and Research In Motion’s BlackBerry devices.

For Overland Park, Kan.-based Sprint, which has been bleeding subscribers to other wireless carriers, the Pre represents a chance to snare new customers while getting current ones to “trade up” from a regular cell phone to the Pre and its pricier service packages, which start at $70 per month.

Tough Competition

The Palm Pre has a touchscreen like the iPhone, but also has a slide-out keyboard and runs on Palm’s new webOS software, which can run several applications at once, unlike an iPhone.

The original Palm Pilot was all about organizing the user’s personal information, and the Pre will take that idea further by synchronizing contacts from Facebook, Gmail and Outlook into a single list — something else the iPhone can’t do. The Pre will connect with Apple’s iTunes software and download music and photos as an iPhone or iPod can, which may be a first for a device not made by Apple.

However, even with its innovations, the Pre will face rough competition. The iPhone continues to be a big draw at AT&T, the exclusive U.S. carrier. Apple might unveil a new version Monday at its annual conference for software developers. Meanwhile, Sprint’s competitors are adding new smart phones to their lineups from RIM, Samsung Electronics, Nokia and others.

Verizon Wireless has even attempted to undercut Sprint, announcing that it will be selling the Pre when Sprint’s exclusive rights expire. Sprint has said that its exclusivity extends to the end of the year, and it may end soon after.

Betting the Farm

By necessity, Palm is betting the company on the Pre, Gartner analyst Ken Dulaney said, because if the handset isn’t popular, the company won’t have enough momentum to approach the smartphone market “with any kind of clout whatsoever.”

BlackBerrys commanded 55.3 percent of the smart phone market in the first quarter, while the iPhone accounted for 19.5 percent, according to research firm IDC. Palm, meanwhile, had just 3.9 percent.

However, Palm executives are quick to point out that feature-packed smartphones are still just a slice of the overall U.S. wireless market — 21.5 percent, according to IDC. As a result, Palm and Sprint think many potential Pre buyers are people who would be switching from a traditional cell phone with fewer functions.

“We’re not looking to somehow defeat Apple or RIM in order to be successful. There’s a huge market opportunity there,” said Brodie Keast, Palm’s senior vice president of marketing.

RBC Capital Markets analyst Mike Abramsky questions whether Palm has manufactured enough Pres to meet the initial demand. However, he thinks that Palm’s success isn’t dependent on the device itself as much as on webOS, which is meant to be the basis of many follow-on phones for perhaps a decade.

“It’s really a bigger and longer turnaround and story about leadership for them in the smartphone market,” Abramsky said.

Suffering Sprint

For Sprint, the Pre is not something that will make or break the bottom line, but a way to help the nation’s third-largest wireless carrier garner more buzz.

For years, Sprint had a reputation for technological innovation and its extensive cellular network. However, that has been overshadowed by missteps after Sprint’s 2005 purchase of Nextel Communications — such as unfocused marketing and difficulty meshing the two organizations. Meanwhile Sprint’s competitors have pushed snazzy smartphones such as the iPhone at AT&T and the BlackBerry Storm at Verizon Wireless.

Sprint tried to fight back last year by offering Samsung’s touchscreen Instinct handset (and a follow-up version that began selling in April), yet that phone has not been a major hit. Last year, Sprint lost nearly 5 million subscribers.

“They really do need something to establish themselves in the market,” said Gartner analyst Tuong Nguyen. “It you want to continue playing with the big boys, you need a big product.”

So what would mark a blockbuster for Sprint or for Palm?

Abramsky, the RBC analyst, thinks investors will be happy if about 3 million Pres are sold in Palm’s fiscal 2010, which started this week. By comparison, Apple sold 6 million iPhones in the first 11 months, at which point the company switched to an upgraded model.

Dulaney, of Gartner, expects 1 million Pres to be sold in 2009, and 4 million to 5 million in 2010.

“I think they’ve done a good job on this product,” he said. “We’ll have to wait and see.”

Social Media

See all Social Media