Social media platform TikTok is experimenting with online shops and shoppable videos to enhance the customer experience for engaging in live commerce purchases.

TikTok in early November quietly launched the e-commerce feature in the U.S. via TikTok Shop. It enables shoppers to purchase products directly through the TikTop app while viewing product videos and influencer presentations.

This feature was previously only available on TikTok in the U.K. and seven Southeast Asian countries. The company is now experimenting with an alpha version integrating the live shopping feature for U.S. consumers.

Current U.S. vendors now participating in the alpha testing program were personally invited to join. TikTok has also set up an application process so other U.S. stores can now apply to join.

This latest move gives in-stream commerce a more prominent focus. TikTok Shop integration in the U.S. is part of an ongoing strategy that might position TikTok to compete with Amazon.

The new maxim for the post-pandemic e-commerce age is that all commerce is social commerce, notes Eric Dahan, CEO and co-founder of Open Influence, an influencer marketing firm. That fundamental principle might well describe the motivation behind this new retail offering.

“Some brands, businesses, and creators are better positioned to maximize the opportunities in this burgeoning landscape. However, the real social commerce success will come from understanding your customers, leveraging influencer relationships for trust and validation, and willingness to experiment on emerging networks — especially TikTok,” Dahan told the E-Commerce Times.

Open Influence works for more than 1,000 of the world’s largest corporations and is a marketing partner of TikTok.

Fitting Into Social Commerce Strategy

Social commerce snowballed during the pandemic when consumers were more willing to shop online. Social media users globally now total about 4.5 billion people, and the U.S. share of that buying population is expected to reach 110 million social buyers.

TikTok’s launch timing could ride the rising wave of social commerce. Industry estimates pegged global social commerce sales at $492 billion in 2021. According to a report by Open Influence on social commerce trends, that number could nearly triple in the next four years.

Given the growing audience size, platforms built more features to help create a seamless customer experience. TikTok could pose a significant challenge to Facebook Shops, one of the largest social commerce platforms, and compete handily with retail sales on Instagram, YouTube, Twitter, and Pinterest, according to industry watchers.

“The social platforms are allowing for purchases to happen within their apps, and creators are now able to tag products directly. That opens the door for marketing to be more ‘bottom-funnel’ for a lot of advertisers,” Dahan observed.

Silently Opening Shop Doors

TikTok, with no pre-announcements or debut fanfare, turned on the shopping lights. Its website displayed an announcement (still showing at this writing) describing its new Shop offering as “an innovative new shopping feature which enables merchants, brands, and creators to showcase and sell products directly on TikTok through in-feed videos, TikTok LIVE(s), and the product showcase tab.”

The company has since announced restructuring TikTok’s U.S. operations to place former North America general manager Sandie Hawkins in charge of TikTok Shop US.

TikTok has been testing in the U.K. and Southeast Asia for a few years. The platform owner calls the U.S. operation a closed-loop experience, noted Laura Perez, global director of B2B communications for TikTok.

“This is a new experience that we have been testing out within the TikTok app we had just launched in the past few weeks in the U.S. It is really too soon to share any anecdotal information on the experience right now,” Perez told the E-Commerce Times.

The previous launches in Southeast Asia and the U.K. first were driven by market demand. She noted that the U.S. has been such a thriving e-commerce market and was one of the first markets to really adopt the whole ‘TikTok made me buy it’ phenomenon.

“That was really started by our community, where people were sharing reviews and the products they loved. It just became this viral trend whether it was clothing, accessories, different food items, books that they love,” explained Perez.

“So it was just the right time and right place to start thinking about expanding into new markets and will always be driven by market demand in that area,” she added.

Rocky Start Not True, Maybe

According to a Financial Times report in July, TikTok reportedly ran into numerous personnel problems and internal obstacles that led to missed goals and a less-than-successful launch in the U.K.

The report claimed that TikTok was changing its plans for a planned U.S. launch of a live-streaming QVC-style shopping experience.

But Perez discredited the accuracy of such reports, maintaining those were based on ill-stated internal information. “We did not pause or delay the expansion of TikTok Shops,” she insisted.

Perez declined to characterize the status of the U.S. Shop launch precisely. She noted that TikTok is still in the process of talking to different merchants and sellers about options and opportunities available in the alpha and beta programs.

“It still is very early in terms of feedback about the practice itself with U.S. merchants and sellers. But I will say there is a strong appetite both from our community and from brands and merchants to figure out how to make their products more discoverable and shoppable on the TikTok platform,” she replied.

She observed that the U.S. launch was one of the first use cases where the power and influence of the TikTok community to drive product sales were evident. The current focus is on making a native experience and ensuring it provides commercial solutions that the seller and user communities like.

“We also want solutions that our merchants can make sure that it is a valuable experience for them and worth their investment,” added Perez.

Free Ride for Early Adopters

TikTok charges sellers and vendors in its U.K. and Asian Shop operations a five percent seller fee. Perez declined to discuss the buy-in costs and whether U.S. Shop vendors will bare that same commission payment on their sales.

“It is a learning lesson from the work that we have done with merchants across the different margins. We need to understand the value that gets onboarded. That is something we will determine once we are fully up and running,” she offered.

When pressed for what temporary arrangements exist, U.S. Shop vendors are now paying or will pay until a final value is determined; Perez disclosed that the alpha and beta testers are not paying any seller fees to TikTok.

“The commission has not been set, so they are not paying a commission to TikTok. But again, we are in the very early alpha stages of the whole business process,” she said.

Minimal Seller Requirements

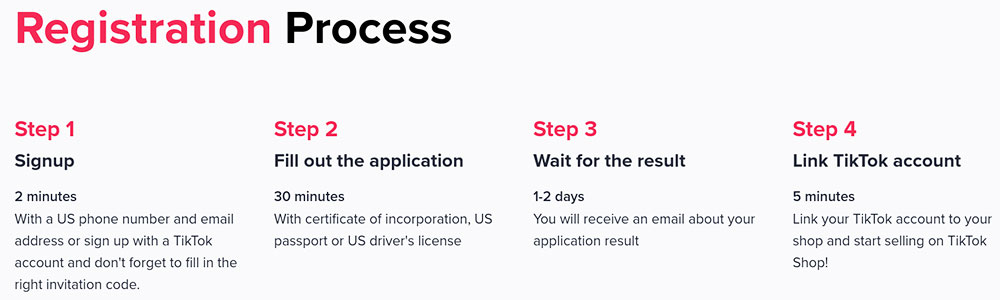

Signing up for a TikTok seller account is relatively easy. But certain requirements may require additional preliminary preparations. Applicant prerequisites include completing an online application, registering for a business account, and passing an audit, and for:

- A corporation: U.S. company registration document and the company owner’s passport or driver’s license.

- An individual seller: U.S.-issued passport or driver’s license.

Merchants, sellers, or product influencers do not need a minimum number of followers on the TikTok platform to qualify for acceptance.

TikTok Shop registration process for U.S. sellers | Image Credit: TikTok

“You can join TikTok Shop and start live streaming with a shopping cart, even if you register a new TikTok account and do not have any followers,” according to the site’s scant FAQ.

Complete details are available at the TikTok Shop Seller Center.

Government Oversight

Issues pertaining to TikTok’s ties to its China-based parent company ByteDance and the government’s penchant for surveillance through technology are not significant impediments to attracting vendors, according to Perez.

“We have been having very transparent conversations with our brand partners for a long time. So, these are not new conversations that we are faced with,” she offered.

TikTok’s U.S. operation leaders learned much throughout 2019 and 2020 when they introduced advertising scale to its brand partners. So providing education on how TikTok in the U.S. handles data security, privacy, and safety on the platform are consistent conversations with advertisers, added Perez.

Still, the potential for government intervention hangs overhead. Last May, Sen. Marco Rubio, R-Fla., released a statement urging President Biden to make it clear that TikTok Shop will not be allowed to operate in the United States.

“Just like TikTok itself, TikTok Shop is beholden to the Chinese Communist Party. It would represent a serious threat to Americans’ personal privacy and U.S. national security,” said Rubio in part.

Maryland, South Dakota, South Carolina, and most recently, Texas have banned the use of TikTok on government devices, also citing potential national security threats.

“We are in active conversations with the U.S. government [to address ] some of their concerns, and that is also a conversation that we are being pretty transparent about with our brand and merchant partners,” said Perez.

Social Media

See all Social Media