Square on Wednesday announced that it had registered with the Securities and Exchange Commission for its long-expected initial public offering.

A startup that specializes in electronic payments, Square has been operating in the red. It plans to raise up to US$275 million in its IPO, it disclosed in its SEC filing.

However, market conditions currently are not considered very favorable for IPOs.

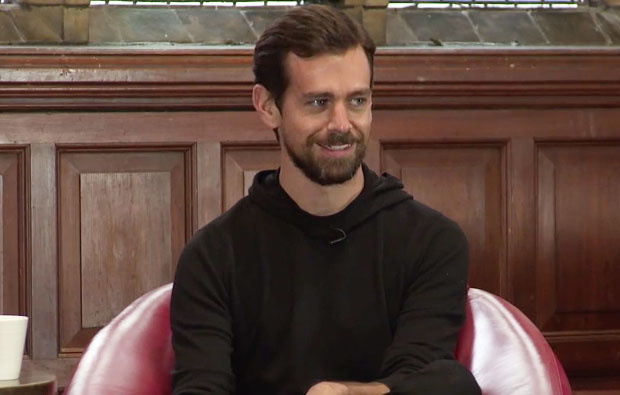

Square’s news made a few heads turn, coming just days after cofounder and CEO Jack Dorsey announced a big move at Twitter — which he also cofounded and where he’s also CEO. At Twitter, Dorsey announced he would cut 8 percent of his workforce.

For the six months ended in June of this year, Square reported a loss of $77.6 million, according to its SEC filing, on revenue of $560.6 million, an increase of 51 percent from a year ago.

Those losses came amid major questions about the overall leadership stability at Twitter, where Dorsey was named permanent CEO less than two weeks ago. That appointment raised fresh questions about just how much time he could give to Square, while wrestling as large a bear as Twitter is in the technology world.

Dual Roles

There is precedent for a visionary dual-role chief executive, according to Colin Sebastian, an analyst at Robert W. Baird & Co., who noted that Apple CEO Steve Jobs and Tesla CEO Elon Musk both ran companies under similar circumstances. For a time, Jobs also helmed Pixar, and Musk currently is chief of SpaceX as well as Tesla.

“Having a strong team underneath Dorsey at each company will help,” Sebastian told the E-Commerce Times. “Realistically, his role as founder at both companies is what allows him to take on these responsibilities, as he has the legitimacy to lead and make strategic decisions.”

Dorsey already appears to be taking steps to build out a stronger team. Omid Kordestani, a founding member and chief business officer at Google, has joined the Twitter board of directors and will serve as executive chairman, Dorsey tweeted Wednesday.

While acknowledging Dorsey’s high level of credibility within both organizations, Sebastian cautioned that the arrangement poses risks for both companies, as each essentially gets half of Dorsey’s time, and noted that his firm will be “watching closely how it works out.’

Square also acknowledged the leadership risk factor in its filing with federal regulators.

“Our future success is significantly dependent upon the continued service of our executives and other key employees,” the company noted in the S-1 document. “If we lose the services of any member of management or any key personnel, we may not be able to locate a suitable or qualified replacement, and we may incur additional expenses to recruit and train a replacement, which could severely disrupt our business and growth.”

The filing specifically notes that Dorsey, as CEO of Square, also serves as CEO of Twitter: “This may at times adversely affect his ability to devote time, attention and effort to Square.”

Square is acknowledging that one man cannot devote his entire being both to running its business and taking charge of such a major entity as Twitter, said Rob Enderle, principal analyst at the Enderle Group.

However, the layoff announcement at Twitter will have no direct impact on Square, he told the E-Commerce Times.

“The issue for Square is now they have a part-time CEO and have to disclose the risk, which could adversely impact the IPO,” Enderle pointed out.

Dorsey most likely will remain at Square’s helm well into the future in order to give both companies a clear picture of their overall health and stability, said Brian Blau, a research director at Gartner.

“Any decision point about Dorsey isn’t immediately after the Square IPO,” he told E-Commerce Times. “In 12 to 18 months from now, we will have a much better picture of both companies in terms of business performance, and how the whole CEO arrangement is working out.”

Twitter and Square officials declined to comment for this story.

Social Media

See all Social Media