Flexa on Monday launched a new digital payment network that uses cryptocurrencies to cut processing costs, eliminate fraud and preserve users’ privacy.

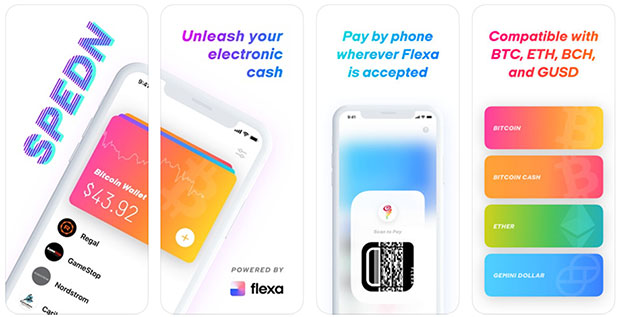

The network uses Flexa’s Spedn app to process consumer transactions at cooperating merchants. The new payment platform makes it possible to spend Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH) and the Gemini dollar (GUSD) at any of the merchants currently accepting payments on the Flexa network.

Flexa partnered with Gemini, a regulated and secure cryptocurrency exchange and custodian based in New York City. Every Spedn digital wallet is fully insured on Gemini’s New York Department of Financial Services (NYDFS)-regulated infrastructure.

The app allows consumers and businesses to spend cryptocurrency in real stores instantly without worrying about volatility, according to Flexa cofounder Trevor Filter. The company sees the new payment platform that handles cryptocurrencies as the future of digital payments.

The existing payments infrastructure is broken, according to Flexa. Alternatives to cash, such as credit and debit cards, are expensive for merchants and prone to fraud.

Instead of bolting cryptocurrency payments on top of debit cards, Flexa built new connections with merchant point-of-sale terminals nationwide. That network bypasses the existing payments infrastructure and pushes cryptocurrency-based payment authorizations, called “flexcodes,” directly to merchants.

The first retailers on board include GameStop, Nordstrom, Whole Foods, Caribou Coffee, Jamba Juice, Bed Bath and Beyond, Lowe’s, and Crate and Barrel.

The safety and reliability of cryptocurrency payments depend on the parties involved in the transaction, according to Charles King, principal analyst at Pund-IT.

“The volatility of crypto prices and high-profile failures and scams befalling some platforms have made commercial usage a tough sell,” he told the E-Commerce Times. “Flexa, through its partnership with Gemini, claims to have fixed those problems.”

Differing Views on Digital Payments

Flexa’s main commercial pitch for cryptocurrencies is that traditional payment systems are broken, overpriced and insecure, while blockchain-based systems offer superior security and efficiency, and they cost sellers and buyers less than standard credit cards, noted King.

However, the viability of crypto is itself a concern, he pointed out. Conventional payment systems are based on and follow the rules of accepted, state-backed currencies.,

“So if things go south, sellers and buyers have formal recourse. That underlying infrastructure doesn’t really exist for crypto,” King warned.

Cryptocurrencies are the root of the payment platform rather than actual currency, explained Chris Morales, head of security analytics at Vectra. They are not stable and are traded like assets as the price has wild fluctuations in value every day.

“From a technical perspective, making a transaction is not a big deal. The risk might be in disputing charges, though, as there is no authority for payment resolution like you would receive with a credit card,” he told the E-Commerce Times.

The pros and cons of the new system fall in line with the acceptance of cryptocurrencies. Trust in the seller and the ability to recoup funds are the biggest concerns for online transactions, Morales said.

“There is a sense of security with backed and insured bank funds,” he noted. “This is non-insured money, and once it leaves your wallet, it is gone.”

How It Works

Retailers in the Flexa network configure their existing point-of-sale scanners to recognize payments from its cryptocurrency app. The customer holds up the app for scanning as with other digital payment systems.

The store cashier does not know the customer is paying with cryptocurrency. The merchants receive a real-time payment in the form of their choosing, either crypto or dollars.

Spedn generates a QR code when scanned at the checkout register. The merchant receives immediate payment in dollars, and the equivalent amount of cryptocurrency is debited from customers’ cryptocurrency wallets in the Spedn app.

Flexa uses its own cryptocurrency, FlexaCoin, to secure each transaction before it is approved by the originating coin’s network. The Flexa Network Protocol works as an intermediary for each payment. The Spedn app lets users spend four types of crypto: Bitcoin, Bitcoin Cash, Ethereum and Gemini Dollar.

After immediately paying the merchant, Flexa goes through the slower process of taking payment from the buyer’s cryptocurrency wallet. The network assumes the risk of not receiving the cryptocurrency from the buyer’s wallet. Flexa uses the FlexaCoin currency as collateral.

Overcoming Challenges

The challenges that come with getting this new digital payment platform adopted are due to the complexity of onboarding, said Avani Desai, president of Schellman & Company. If you want to open a bank account, you can walk into a branch and easily open up an account. If you want to open a crypto exchange account, you have to go through a lot more hoops.

“If you are not technically savvy, it can be daunting. You need to understand cryptography, hashes, provide personal information, all online. That is a deterrent to many people since it is not the usual. Therefore, we see a lack of adoption,” she told the E-Commerce Times.

Every new innovation or invention comes with its fair share of legal, security and privacy concerns. Cryptocurrencies are no exception, Desai added.

Currencies and payment systems are among the most conservative and highly regulated businesses globally, noted Pund-IT’s King. So offering to replace them with something new and largely untried will be difficult, at best.

However, Flexa’s advisers include many people with deep experience in traditional, large-scale finance and retail. Plus, Gemini is working to meld the benefits of crypto with the stability of traditional currency.

“In other words, Flexa appears to be making a serious run at creating a workable, sustainable alternative to traditional payments. It’ll be interesting to see where the company goes with this,” said King.

Crypto Underpinnings

Cryptocurrencies are based on blockchain technology and are decentralized to enhance security, explained Schellman & Company’s Desai.

The virtual nature of the blockchain technology necessitates the need for utmost privacy and security. Blockchain is the technological spine of the crypto world. It can help prevent mega-hacks, she said.

“The ever-growing popularity of cryptocurrencies is attributed to distrust towards traditional markets and the need to establish a new financial system,” Desai continued.

With more individuals and companies adopting cryptocurrencies, there is a need to put up additional firewalls so that the privacy and security of investors continue being safeguarded, she cautioned. The mass adoption of cryptocurrencies is an indicator that they are gaining mainstream acceptance and, therefore, the onus is on developers to implement tighter security mechanisms.

Social Media

See all Social Media