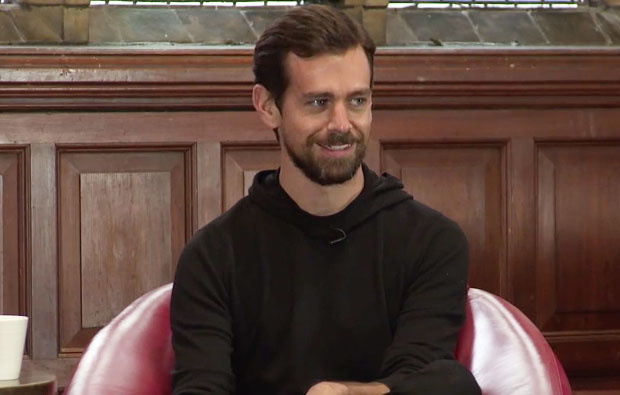

Twitter cofounder Jack Dorsey, who has been running the company as interim CEO for the past three months, has taken the reins for good, the company revealed in a document filed with the SEC last week.

Former CEO Dick Costolo has left Twitter’s board of directors, and Adam Bain has stepped into the chief operating officer role.

Dorsey will continue to lead Square, the mobile POS company he founded, as well.

Desperate Times

Dorsey’s challenge now is to lead out of the quagmire it’s in.

Twitter’s move “seems like an act of desperation,” remarked Mike Jude, a research manager at Frost & Sullivan. “They originally ruled him out of the running for CEO because of concerns about his ability to run two companies.”

Square itself is fighting fierce competition.

“Jack Dorsey may be a lot of things — talented, visionary, hardworking — but being the CEO of two public, fast-growing, game-changing companies is deeply unwise and will be detrimental to both,” predicted Barry Randall, chief investment officer at Crabtree Asset Management.

Twitter did not respond to our request for further details.

What’s Bothering Investors

Twitter has lost considerable ground to rival Facebook, whose worldwide membership had grown to nearly 1.5 billion as of August, according to Statista.

At 316 million, Twitter ranked No. 7 among social networks, and its growth has been tepid.

In Q1, it gained a mere 4 million new members. Twitter initially claimed it had added twice that number, blaming the lower figure on a faulty iOS 8 integration. Later, however, it acknowledged there was no bug, and the 4 million count was correct.

Social TV engagements on Twitter — meaning people who comment about TV programs — had fallen by 25 percent over the previous seven-month period, RingDigital reported this spring.

Twitter “has an unhealthy fixation with user growth,” Randall told the E-Commerce Times, that is “driven by Silicon Valley DNA: Growth is paramount until all opposition is vanquished.”

That approach is “nonsensical” because Twitter “created and now dominates the microblogging space,” he pointed out, and the slowing growth indicates market saturation rather than failure.

Nevertheless, Twitter’s stock price reportedly was down by 50.7 percent from a year ago, as of Monday, lagging the S&P 500 index.

Although TheStreet rated Twitter stock a sell, that analysis “is formulaic and doesn’t take into account Twitter’s unique status,” suggested Crabtree’s Randall.

The company’s revenue grew 61 percent year over year, and it has 7 percent operating cash flow margins, he pointed out, “a problem a lot of other public companies would love to have.” Also, Twitter has twice as much cash as debt.

Follow the Money

Twitter’s main problem is monetization, Frost’s Jude told the E-Commerce Times.

“How do you monetize short text sound bites?” Jude asked. “At some point, there will have to be some sort of pay-to-play arrangement, either through acceptance of advertising or personal information sharing for the purposes of advertising, but that might not sit well with subscribers.”

Further, there are mounting suspicions that Twitter’s subscription figures are “highly gamed — lots of fake subscribers, for example,” which has begun eroding confidence among advertisers and politicians who want to use Twitter, Jude pointed out.

There Can Be Only One

Meanwhile Square, which is gearing up for an IPO, is facing stiff competition from the likes of PayPal and Intuit and a host of other players, Jude said.

“One could argue that [Dorsey] is taking on two very demanding jobs, either of which would fully consume a regular CEO,” he said.

Twitter is a publicly traded company, and “there’s a significant opportunity for lawsuits if he’s not successful,” Jude pointed out. Shareholders “would argue that his split loyalty violated his fiduciary responsibility to the corporation, and they would be right.”

Social Media

See all Social Media