Intel has agreed to acquire Mobileye, a developer of autonomous vehicle technology, for US$15.3 billion in cash, the companies announced Monday.

Intel will integrate Mobileye’s computer vision and mapping technology for autonomous and semi-autonomous vehicles into its Automated Driving Group, to be led by MobileEye CTO Amnon Shashua. Intel SVP Doug Davis will oversee engagement across various Intel groups, and report directly to Shashua.

The combined company will be the leading technology provider in the autonomous vehicle industry, Intel CEO Brian Krzanich told Wall Street analysts in a Monday conference call.

“We believe this combination will accelerate this auto industry innovation by delivering the world class edge-to-edge solutions at a much lower cost [and] faster time to market,” he said.

Lucrative Market

The market for the vehicle systems, data and services market will reach more than $70 billion by the year 2030, Intel has estimated.

The agreement extends Intel’s strategy to invest in data-intensive opportunities that build on its strengths in cloud computing and connectivity to devices.

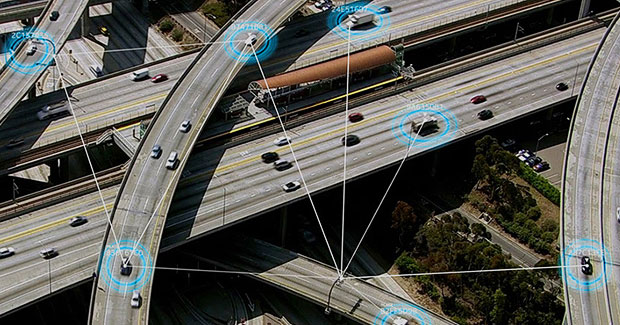

Autonomous vehicles will generate 4,000 GB of data per day by 2020, the company estimated, creating large-scale opportunities for Intel Xeon processors, EyeQ4 and EyeQ5 SoCs, high-performance FPGAs (field programmable gate arrays), memory, high-bandwidth connectivity and computer vision technology.

The acquisition will be accretive to earnings and cash flow immediately, and it will be funded with cash from its balance sheet, Intel said. The deal has been approved by both companies’ boards of directors.

Mobileye, founded in 1999, is one of the world’s leading suppliers of computer vision solutions for advanced driver assist systems, with more than 16 million cars worldwide using its EyeQ chips. The company had revenue of $358 million in 2016 and non-GAAP net income of $173 million, or 73 cents a share.

The Mobileye name and brand will remain intact, except for a slight logo change to reflect the Intel integration, Shashua and Mobileye CEO Ziv Aviram said in a memo to employees. The company’s relationships with OEM customers, Tier 1 partners and STMicro, its EyeQ roadmap and its after-market division operations, will not be interrupted.

The acquisition strengthens Intel’s aim to become a major supplier to the semi-autonomous and fully autonomous vehicle market, building upon its initial acquisition of Wind River from 2009, according to Jack Nerad, executive market analyst for Kelley Blue Book.

Wind River’s embedded devices are used in vehicle infotainment and telematics, which are key building blocks in semi-autonomous driving, he said.

“Intel sees vehicle computing as a growth area at a time when its desktop and laptop opportunities may have peaked,” Nerad told the E-Commerce Times.

Other Relationships

Intel and Mobileye have been working with BMW on self-driving cars, making theirs one of a dozen or so ventures involving technology firms with automakers, Nerad noted.

The three companies announced an agreement in January at the Consumer Electronics Show to begin testing a fleet of 40 autonomous vehicles by the second half of 2017. The cars will feature Intel Go solutions for autonomous vehicles, including Xeon processors, Intel Arria 10 FPGAs and Intel solid state drives.

BMW last month entered a deal to use Mobileye’s road experience management technology to crowdsource mapping information for BMW’s 2018 vehicles equipped with advanced driver assist system technology.

The pace of consolidation in the autonomous vehicle industry could have a limited impact on competition down the road, as various teams work on their own unique sets of technologies, observed Steven Polzin, director of mobility policy research at the University of South Florida’s Center for Urban Transportation Research.

“It also begs the question of the relative merits of retaining a competitive and arguably creative set of players versus the consequence that new knowledge will not necessarily be shared,” he told the E-Commerce Times, “perhaps delaying the pace of innovation and/or introducing the inefficiency of duplicative learning experiences.”

Social Media

See all Social Media